|

|

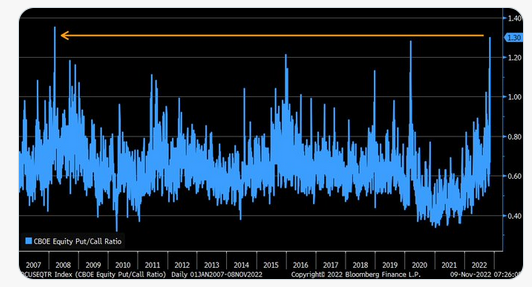

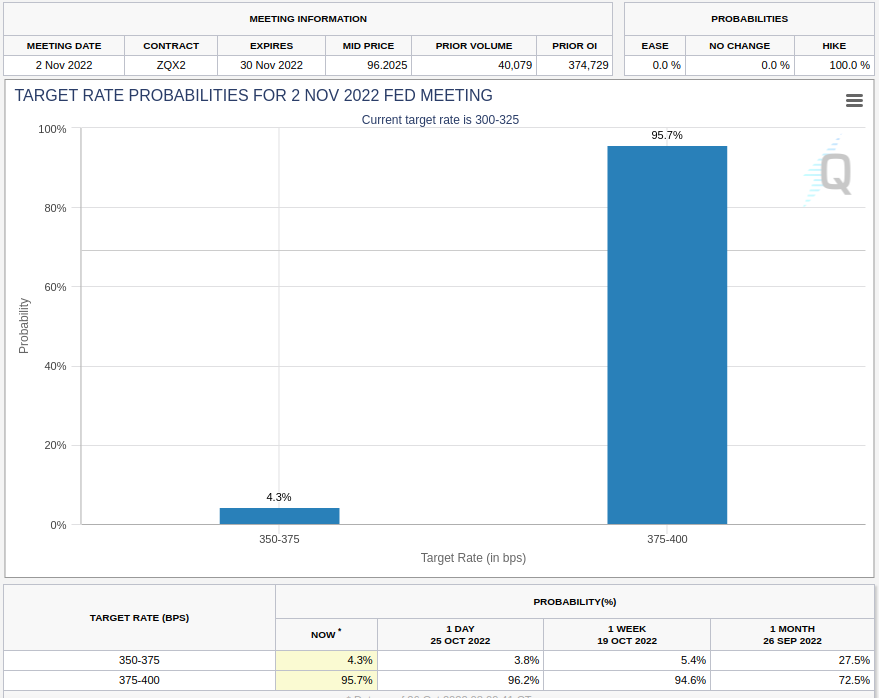

I'm not sure why, but the CPI numbers surprised a LOT of people this morning as evidenced by this MONSTER rally we're getting in equities and treasurys today. If you've been paying any attention at all, you would have known that many of the individual inflation components have been coming down hard in recent months. Yet, even with that information, people have been buying protective puts at rates approximating those of March 2020 and even March 2008. More than a little crazy.

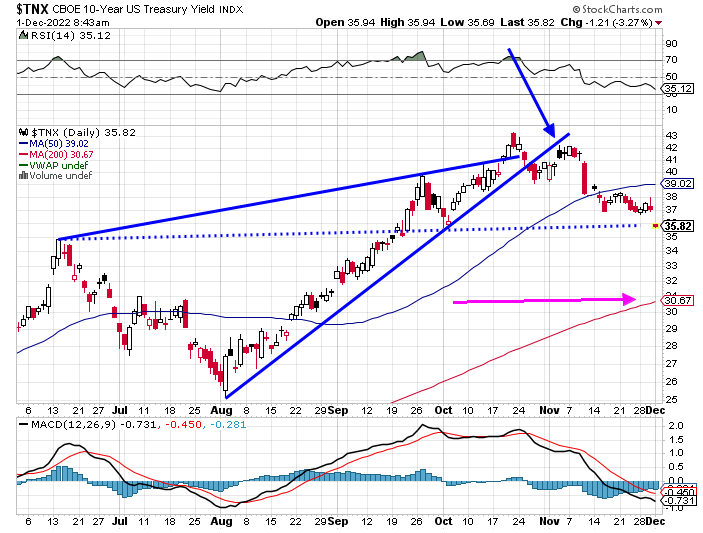

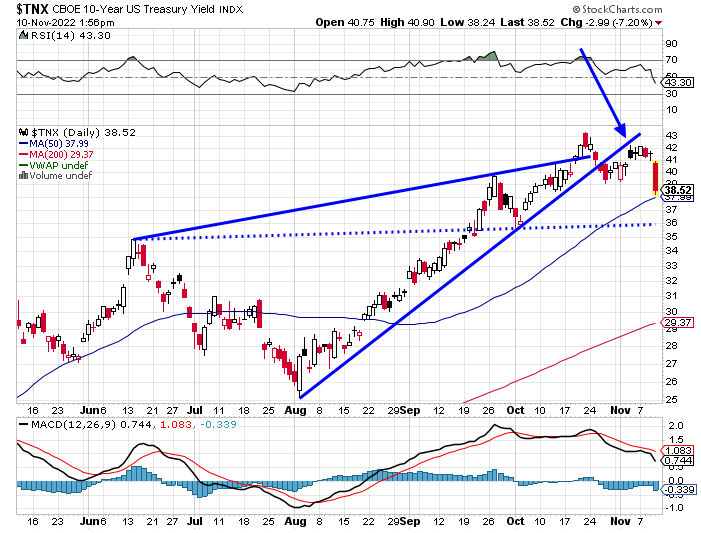

Anyway, opportunity is born out of these kinds of extremes, and I thought it was important to update this chart below.

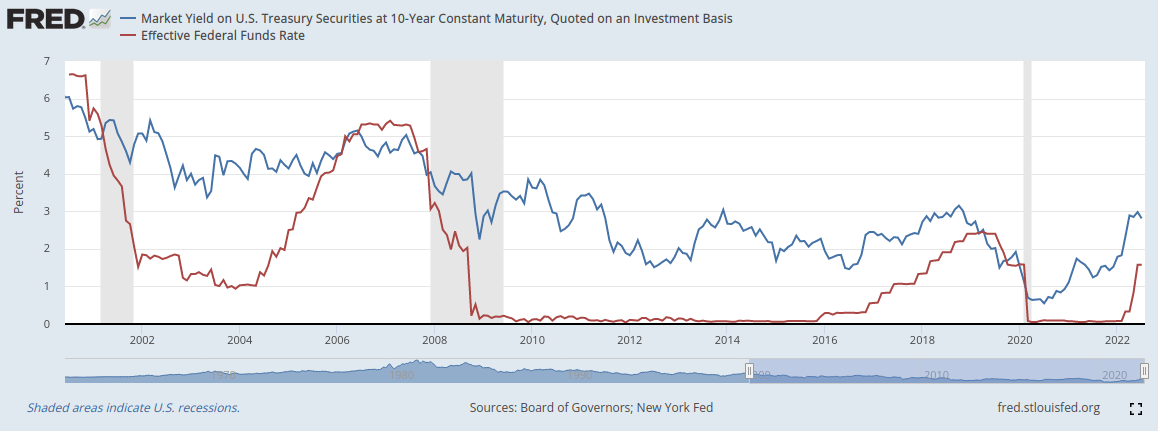

This was a classic Wolfe wave that I referenced below on October 26. It is very common for an initial break below the lower trend line to retest the under side of it as it did at the arrow. But the news today on inflation caused the massive flight into the 10-year, bringing down yields in a big way. I still expect the yield to hit that 3.6% area in the short term, but we'll see.

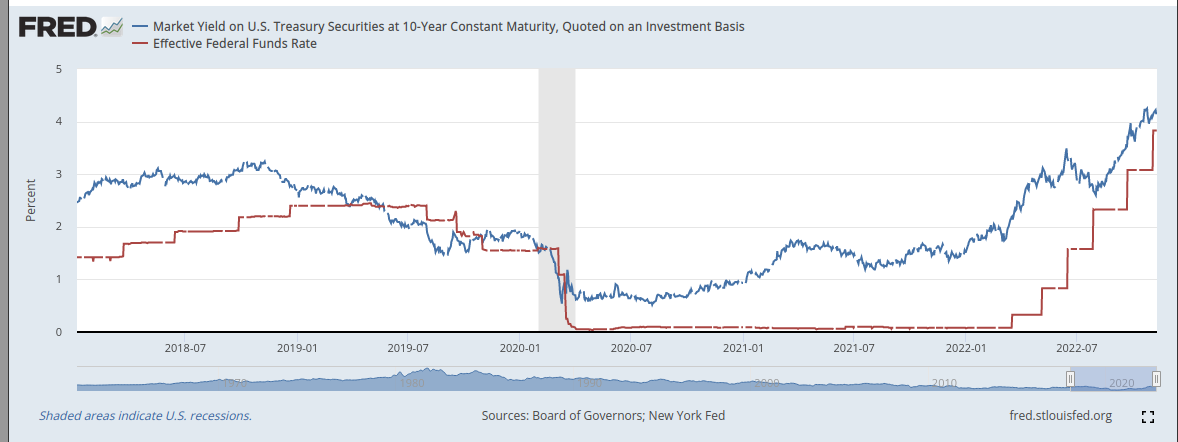

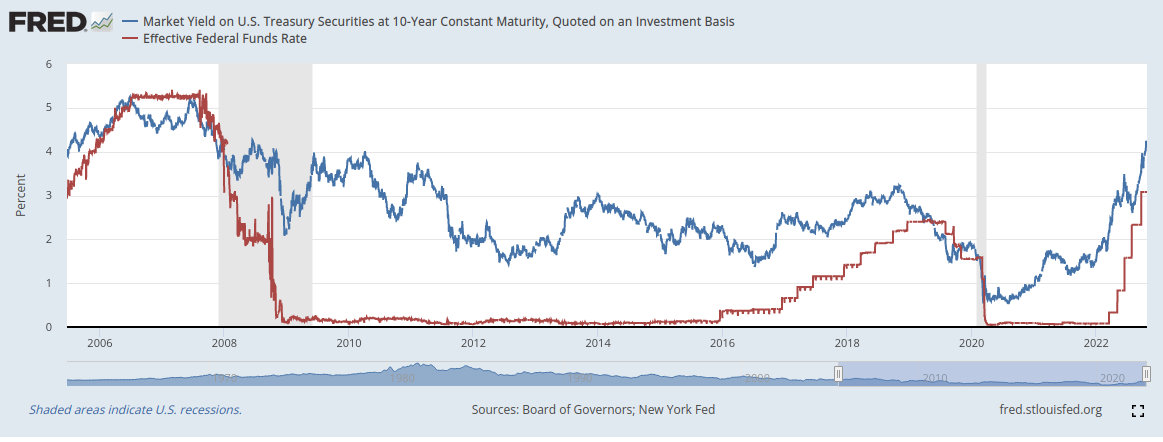

I love Warren Mosler's characterization of the Federal Reserve as like the kid with a toy steering wheel in the back seat pretending to drive the car. The inflation we've had this year has mostly been supply side, which is nearly impossible for the Fed to control. Their hiking campaign has been pretty regressive as it affects the poor disproportionately. Anyway, there is now evidence that the hiking cycle is nearing an end as the 10-year yield is about even with the effective Fed funds rate. Once the 10-year yield goes below the Fed tends to at least pause.

Here's that updated chart:

The 10-year yield for today is not shown on that chart yet. It is at 3.85% as I write this, which is almost even with the effective Fed Funds rate as of yesterday. The Fed may "declare victory" over the coming weeks and months. They've been having a lot of fun with that toy steering wheel!

I'm still looking for a year-end rally in stocks, and it may have already begun.

Last week, the 10-year yield overshot the upper trend line that has been in place since mid-year. The chart below has the look of a classic Wolfe Wave pattern. The yield sits right on the lower trend line, and the target for a break would be the dashed line, which is around 3.57% or so.

The point of all this is to say that, in the past, the Fed has stopped its hiking cycles when the effective Fed funds rate exceeds the 10-year Treasury yield. And if they do indeed raise to 3.75 to 4 next week and the 10-year yield falls to the mid 3s, then that will happen.

We'll have to wait and see how it plays out.

| SEVN | SEER | GO | RPRX | NNBR |

| ADI | NXPL | RUSHA | SLI | VSCO |

Nothing on this site is meant to be a recommendation to buy or sell securities nor an offer to buy or sell securities. Use this information at your own risk.

Your continued use of this site implies agreement with our terms and conditions, which may be revised from time to time.