Rebate Rate

So what is the rebate rate? We're all aware of the fee rate to borrow stock in order to sell it short, right? OK, well, maybe I'm a bit too presumptuous. Let's start at the beginning.

Say you want to short a stock. You've done all the due diligence and you've determined that the stock is overvalued. How do you go about that? For most stocks it's a matter of just contacting your broker and placing the order. That's because for most stocks finding shares to borrow is easy.

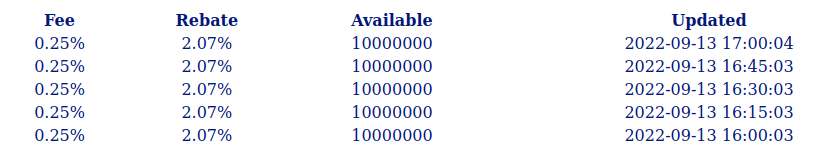

Let's take a look at Apple (), for instance.

As you can see the fee rate, the cost to borrow the stock in order to short it, is pretty low at 0.25%. That's an annual rate. The number available is 10,000,000+. So basically you can borrow all you want.

In fact, and this is something that a lot of people are not aware of, when you borrow stock the broker will make you put up a like amount of collateral to minimize their risk. The rebate rate is what they pay you as they hold that collateral.

So, in the case of AAPL above the net to you as a short would be 1.82%. If you're right about the trade you can also make money on the stock's price movement.

Hard to Borrow Stocks

But what if a stock is hard to borrow? Let's say it's a thin small-cap stock that has already been shorted a ton. You check with your broker and they say exactly that. The number of shares to short is small or non-existent. The fee rate can be high, etc.

But what about the rebate rate? Let's take a look at some examples.

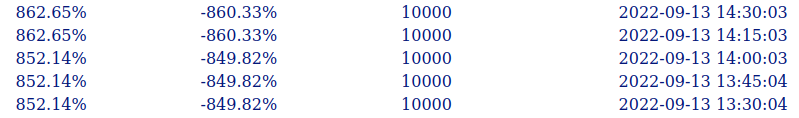

I'm not recommending anyone buy or sell short FAZE or any other stock I mention here. Seriously. Do your own due diligence. BUT TAKE A LOOK AT THOSE RATES!

Wow. As of this afternoon the fee rate was a whopping 862.25%, but not only that, it has a negative rebate rate of 860.33%. There were not many shares available to borrow at those rates and then it went zero borrow again later this afternoon.

Why anyone would want to sell short a stock with those kinds of borrow rates is beyond me, but it is what it is.

A crowd favorite, Gamestop () also has a punitive fee rate. Anything above 5% is considered punitive. Here are its numbers from a bit ago:

There aren't very many shares available to short this afternoon. The fee rate is pretty high at 10.11%, but you must also be aware of the extra cost associated with the trade (the negative rebate rate).

Let's look at one more.

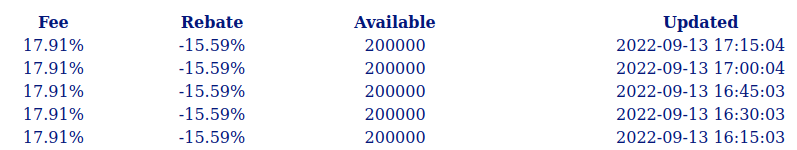

Another meme stock, also has some very interesting short availability numbers.

There are more shares available, which would seemingly make it more attractive to short, but look at the rates. The fee rate is quite high at 17.91%, but the rebate rate is really high as well. Twice as much as the rebate rate for Gamestop.

For whatever reason the broker has decided that it must be more highly compensated for a short sale in .

In Summary

So there you have it. The fee rate is very important for determining the potential profitability of a short trade, but it is only part of the picture. The rebate rate must also be considered as it can add a substantial cost to any trade.