The trading system is the crowning achievement of decades of market study coupled with the ability to programmatically backtest a very large number of scenarios.

The end result is a system that you can rely on to help you get through the most difficult market environments-- like now. Anyone can make money during a bull market. Most stocks are going up and you really can buy just about anything and ride the wave. It's the bear markets that expose weaknesses in market models.

No Margin

Margin is a double-edged sword. It can be exhilarating to watch a leveraged position go up when you're right. The down side is that you can literally be wiped out in a single trade. Most people hold just a few stocks in their portfolio, and a single leveraged position going against them can be devastating.

The trading system was designed to eliminate risk in several ways. First of all, it encourages people to hold at least 20-30 stocks, and you have the ability to hold as many as 50. People are always talking about how important it is to have a diversified portfolio. Well, our statistical analysis proved this out. I will discuss this a little later in this article, but over time your portfolio will perform better with more stocks in it. Also, the trading system was designed to use no margin, therefore completely eliminating that risk.

Investing is not very exciting

The fact is, a lot of people are hooked on the thrill of trading/investing. Yes, you can make a lot of money in a short period of time, which is thrilling. However, your systems have to be able to withstand the inevitable losing trades and drawdowns. A drawdown is simply a position you're holding that is below where you bought it. The best trading system is one that can remove the emotion both good and bad. People tend to make the worst trading decisions when they're either elated or depressed. Those decisions eventually wreak havoc on a portfolio. Our trading system doesn't trade a lot. The average stock only has something like 3-4 round-trip trades per year. That's not a lot of action so be prepared for that.

Performance

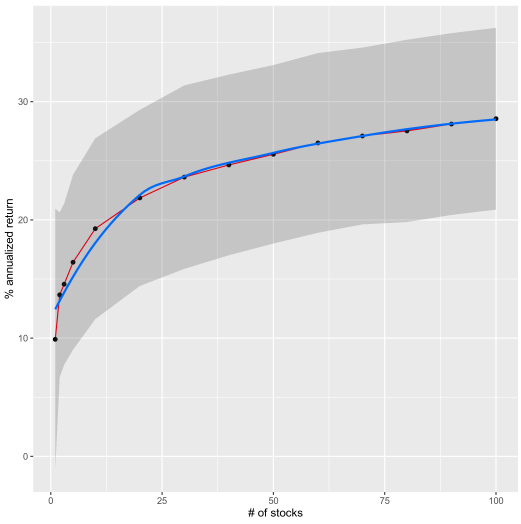

Of course, the gains have to be there, and our trading system has them. The following graphs are interesting in that they show the importance of diversification.

These graphs were created by backtesting our trading system by choosing a random number of stocks from the S&P 500 and then running that portfolio through the system. We did that 1000 times. This is called bootstrapping and is a standard statistical technique.

Notice how the annualized return increases as the # of stocks increases. There's a limit to this, of course, but the point is that holding more stocks in your portfolio is better. Holding fewer stocks hurts performance. Couple that with emotional trading and a bad investing model and, well, we don't even want to go there.

The gray shaded areas represent the 95% confidence interval of an expected result. 95% of the time the annualized performance of the sample portfolio was within these gray areas. So, for example, if the portfolio was 50 random stocks you can see that the annualized performance was anywhere from 18-36%. This is excellent! However, it's also just a backtest so keep that in mind.

S&P 500

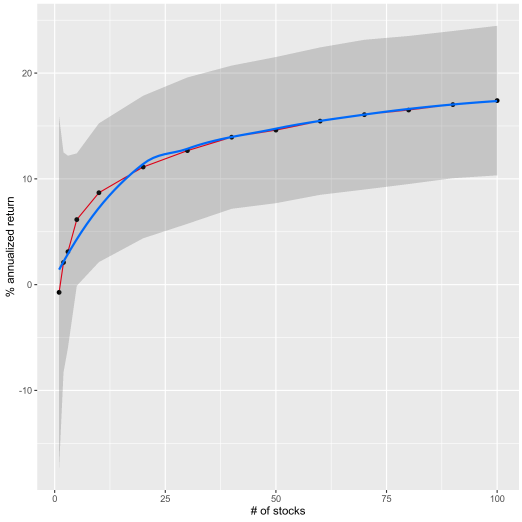

This second graph is the same thing except that it's a randomly chosen portfolio from the Russell 2000. Performance is worse for small caps overall. Yes, there are outsized gains that can be made individually in small cap stocks, but overall it's better to have a portfolio of more predictable mid- to large-cap stocks.

Russell 2000

Realistic Signals

We have tried to design this system to be as realistic as possible after

seeing some abysmal things on the internet. Some "systems" are so

deceptive that they will issue a buy signal for the beginning of a

trading day based on that trading day's results. Obviously this is not

possible.

Our trading signals are generated after the close of every trading day. The system tells you exactly what it has decided to do after the day's trading. First of all, the trade could have been stopped out. Every trade has either a 15 or 20% stop loss based on the trading program you choose for each stock.

So if the trade was stopped out the system will tell you and it exits the trade. Otherwise, it will say it has one of the following: no position, holding, buy at open, or sell at open.

The buys and sells are for the open of the next market day, which you can place with your broker the night before. So literally you can do all your portfolio management in just a few minutes each night using our system.

Transparency

Our system is fully transparent. You can look up the results of any stock we cover and decide if you'd like to include it in your portfolio. Not all of the stocks we cover are winners. Not by a long shot.

However, there are many more winners than losers, and this is what's important. Take a look at some of the winners our system has produced:

|

Company

|

Win %

|

Annualized Gain

|

|

ACRE

Ares Commercial Real Estate Corporation Common Stock

|

100.00 |

11.07

|

|

APG

APi Group Corporation Common Stock

|

100.00 |

51.60

|

|

BIPC

Brookfield Infrastructure Partners LP Class A Subordinate Voting Shares

|

100.00 |

15.23

|

|

CARR

Carrier Global Corporation Common Stock

|

100.00 |

24.50

|

|

CARR

Carrier Global Corporation Common Stock

|

100.00 |

75.23

|

|

CHK

Chesapeake Energy Corporation - Common Stock

|

100.00 |

49.42

|

|

CHK

Chesapeake Energy Corporation - Common Stock

|

100.00 |

24.60

|

|

CNXC

Concentrix Corporation - Common Stock

|

100.00 |

45.42

|

|

GPMT

Granite Point Mortgage Trust Inc. Common Stock

|

100.00 |

19.78

|

|

LW

Lamb Weston Holdings, Inc. Common Stock

|

100.00 |

20.87

|

|

This screenshot is from our "Daily Trading Signals Tool" that subscribers can use to build their list of 50 stocks. These are just a few of the stocks on the list (there are more than 1000 on that list), and they may not continue doing well in the future, but they certainly have done well so far.

Give it a try

We can't promise anything, of course, but we think your results will be better if you use our trading system.